Why Your Company Needs a Workers’ Compensation Fraud Investigator

To protect your company against losses resulting from workers’ compensation insurance fraud — whether you are a business owner, human resources employee, or manage an insurance company — you need a combination of using certain best practices and hiring the right professionals. On average, insurance fraud costs each family in the United States about $400 to $700 per year. Specifically, workers’ compensation insurance fraud is the fastest-growing type of insurance fraud.

Fortunately, you can use specific tactics to spot and stop workers’ compensation fraud before you or your employees incur the potential damages. Keep reading to discover common examples of workers’ compensation fraud, signs of fake insurance claims, how to report suspected incidents — and why working with an expert in the security industry like Silverseal can help.

What Is Workers’ Compensation Fraud

While working for your company, your employees may experience injuries or develop illnesses that may render them unfit to work. This inability to work could lead to loss of income for the employee and medical bills to pay for their treatment. Provided the injury is not self-inflicted or incurred because the employee violated or neglected your company’s safety policies and practices, they can pursue compensation insurance.

This option serves as the safety net for your employees and company to replace lost income and cover medical bills when injuries or illnesses occur in the workplace or as a result of working. Without workers’ compensation insurance, your company may pay for these expenses out of pocket — and in critical cases, these expenses may cut deep into your company funds and affect your operations and profitability.

In all U.S. states except Texas, workers’ compensation insurance is compulsory for companies with at least one employee. However, whether the law demands it or not, it is always in your company’s and employee’s best interest to purchase a workers’ compensation insurance policy for your company. This way, you can ensure everyone involved is protected.

Unfortunately, employees could use the ease of receiving payment for injuries as an opportunity to receive free money through false injury claims — otherwise known as workers’ compensation fraud. It refers to any lie, deception, or misrepresentation made in an injury compensation claim for financial gain. Ultimately, employers, employees, insurance companies, and employee health care providers can all commit workers’ compensation frauds.

How Does Workers’ Compensation Fraud Impact Your Business?

Regardless of the perpetrator, workers’ compensation fraud has the same effect on your company’s finances and the welfare of your workers. If unnoticed and mitigated, false insurance claims may lead to an increase in your company’s insurance premium. This issue may directly affect your business funds, cut down your profitability, and negatively impact the availability of workers’ compensation funds for employees who genuinely need it.

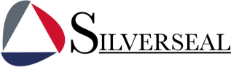

5 Examples of Workers’ Compensation Fraud

Both your employees and health care provider can commit workers’ compensation fraud, which is easy to perpetuate and conceal for months without notice. To help you fully understand what workers’ compensation fraud looks like, here are five scenarios and examples to consider:

- Invented injuries or illness fraud: An employee can make up an injury or illness to get some time off and receive the financial benefits of your workers’ compensation insurance policy. For example, an employee may make up a hearing loss from daily phone calls to take time away from work while benefitting financially.

- Inflated injuries or illness fraud: An employee can exaggerate their injuries or illness to demand time off and file for injury compensation. For example, someone in your warehouse may incur a few bruises from stacking and moving products but reports a broken arm or joint dislocation to get more time off and receive a larger workers’ compensation check.

- Non-work-related injuries and illness fraud: An employee can undergo an injury while working on a side job or engaging in a sport but report it as a work-related injury. For example, an executive may file a workers’ compensation claim for a slip and fall injury in your office when they actually sustained the injury from playing basketball or skiing over the weekend.

Here are two examples of employer health care provider fraud:

- Exaggerated illness or injuries fraud: An unscrupulous health care provider may submit an inflated medical report for an employee’s injury or illness to receive more payment from your insurance company. For example, a health care provider may report a bone fracture when the actual injury was a minor dislocation to get more payment for treatment.

- Made-up injuries or illness: A dishonest health care provider may make up an illness for an otherwise healthy employee to take advantage of your workers’ compensation insurance. For example, they could report an internal injury or bleeding for a healthy worker in your warehouse who fell from a ladder to receive payment for treatments. The health care provider may or may not do this in collaboration with the injured employee.

There are always telltale signs of suspicious workers’ compensation claims that may signal a possible fraud. When you observe these signs, a proper investigation will enable you to gather more information.

Top 9 Signs That Could Indicate Fake Injuries or Workers’ Compensation Fraud

About three out of every 100 full-time workers endure an injury at work, so most of the workers’ compensation claims you process are likely legitimate. Injuries do happen in the workplace, so denying truly injured employees their benefits may put your company in a difficult situation with the law. Furthermore, it is always best to give employees the benefit of the doubt, as lying to capitalize on workers’ compensation is not a common occurrence. You can trust your employees while keeping a watchful eye at the same time.

That is why it is essential to know what distinguishes a false compensation claim from a real one. How do you differentiate between truly injured workers from those who want to abuse the system? Here are nine signs of workers’ compensation fraud.

1. Your Employee Reports an Injury or Illness After the Weekend or a Holiday

If an employee shows up on Monday or after a holiday to report an injury or illness claiming it happened in your workplace, the employee may be lying. There is a chance they incurred the injury during the weekend while working a side job or participating in a sport.

For example, if an employee reports an illness just after Thanksgiving, the employee may have developed the illness during the few days they were at home or out of town.

2. Your Employee Has No Witness to the Injury

When an employee who typically works with a team reports an injury and claims there was no one around when the incident occurred, the employee may be lying. That is because no one can verify if it happened in the workplace or if the employee complied with your company’s safety policies and rules when the accident occurred. There will not always be a witness, but if you know the specific employee rarely works alone, your suspicions may be justified.

For example, a construction site worker may claim they fell and broke an arm, but there was no one with them when the incident happened. The worker may have violated company safety rules or incurred the injury the day before while working on a side job.

3. Your Employee Tells Inconsistent Stories in the Injury Report

If an employee renders inconsistent and conflicting accounts of the time, date, place, and events of a reported injury, the employee may be attempting to falsify an insurance claim.

For instance, someone may claim they fell and broke their arm in the morning while setting up for work, but after further questioning, they say the incident happened during lunchtime. That is a red flag that may require further investigation. While the employee may feel anxious about the situation, there is no need for workers with genuine injuries or illnesses to lie.

4. Your Employee Cannot Remember the Full Story

For example, an employee may report an injury and claim the incident occurred four months ago but cannot remember how it happened or why they did not report it when it happened. This scenario could even happen after the employee has already made a full recovery. While some workers may not realize they can file for workers’ compensation for an injury, it is unlikely for employees to say nothing about an injury just to file a claim later. Those with genuine claims will report the injury immediately with accurate details.

5. You Get an Injury Claim From a Disgruntled Employee

When an employee with a track record of poor work behavior or inadequate performance files a claim for an injury or illness, the employee may be lying and want to exploit the opportunity to “get even” with your company and leave with compensation. This situation can also happen with someone who is close to leaving the company permanently.

For example, someone who is about to be fired for funds mismanagement may file a false injury claim as payback.

6. The Employee Is Known to Constantly File for Compensation

If an employee files for a compensation claim after receiving payments for similar claims in the past, the employee may be lying, having found an easy way to make money consistently. While workers can become injured or ill while on the job, it is rare for employees to continuously do so over a short period of time. Someone dealing with two different work-related injuries in a few months is not usually a common occurrence.

This scenario may happen when a worker who recently received injury compensation for hearing loss decides to file for compensation for wrist pain not long after their first injury.

7. Your Employee’s Story Is Not Corroborated by Other Employees

When an employee reports an injury, but the employee’s team members or co-workers do not agree with the report, the employee may be lying. The employee’s colleague may have seen the employee engaged in other non-work-related activities like working a second job or engaging in sports that could cause similar injury. Additionally, an employee may claim to have endured an injury at a certain time, while a co-worker states they were there and their claim is not true.

8. Your Employee Is Unreachable After Filing a Claim

If an employee reports an injury and immediately becomes unavailable or unreachable, does not show up for work, or does not reply to emails or return calls, the chances are the employee may be falsifying their claim. An employee who was actually harmed or became ill while on the job will likely want to work with you to ensure they get the claim.

9. Your Employee Refuses to Take a Test After Filing a Claim

For example, someone may be lying about an injury claim if they refuse to go for an MRI or X-ray scan after filing for a shoulder injury.

These nine signs are not complete proof of fraud, but a call for further investigation and questioning to gather more information to report the fraud. It is not always easy to separate genuine injury claims from fraud cases. That said, these signs will help you detect fraud and immediately report the fraud or launch a workers’ compensation fraud investigation to uncover the truth of the claim.

What Is a Workers’ Compensation Investigation?

Always conduct an investigation for every injury, accident, or compensation claim before taking action. Keep in mind that the purpose of a workers’ compensation investigation is not to falsify an employee’s claim, but to ensure your company does not get ripped off by employees or health care providers. Employers should go about the investigation with the mindest that the employee is likely being genuine, but they simply want to ensure every box is ticked.

A workers’ compensation investigation involves using specific information to verify the employee’s claim. To investigate a suspected workers’ compensation fraud, it pays to hire a private investigator. A private investigator can gather information on the employee’s activities and how they may have contributed to the reported injury. The private investigator may provide this information in form of surveillance videos, audio reports, pictures, or statements from friends or neighbors of the employee.

At Silverseal, our private investigators possess the training and skillset required to help you gather the information you need to verify your employee’s claim through ethical and legal means. After an investigation, if the evidence does not correspond with the employee’s story, it is advisable to report the case immediately.

How Do You Report Suspected Workers’ Compensation Fraud?

As a business owner or insurance company, what are the steps you need to follow to report a case of suspected workers’ compensation fraud?

After an investigation provides substantial information to support a suspected case of workers’ compensation fraud, proceed to report the case to either your state’s Department of Labor (DOL) or your insurance provider. Your DOL takes it from there to conduct their own investigation and provide the appropriate penalty. For an insurance company, after investigation provides information that supports a case of reported insurance fraud, report the suspected employee to your state’s DOL. Your state’s DOL will handle the issue and may prosecute the employee if needed.

You can find a form to report suspected cases of workers’ compensation fraud on your state’s DOL website. Additionally, cases of employees receiving Social Security disability funds while receiving workers’ compensation can be reported to the office of the Inspector General of the Social Security Administration (SSA) hotline or submitted using the report form on the SSA website.

In all cases, guilty employees either receive fines, jail time, or are asked to return in full the money they received from the fraud.

Reasons Why Your Company Needs a Workers’ Compensation Fraud Investigator

A workers’ compensation investigator can work discretely to help you uncover hidden details in a suspicious injury claim.

Hiring a private fraud investigator who is neutral stands in the best position to gather the information that can either verify an employee’s claim or build your case of a fraudulent claim. In-house investigators may be too attached to your company to provide objective information on your employees’ claims. For serious situations like these, you want to rely on a professional third party.

Fraud investigation usually involves surveillance of the employee and background checks with friends, family and neighbors of your employees to gather information on the suspected employee’s activities after filing a claim. There is always the possibility that your employee could easily recognize an in-house investigator. That scenario can trigger a counter-surveillance response from your employee and can ruin your chances of gathering adequate information on your employee’s claim.

Hiring a private fraud investigator is a smart investment to ensure your investigation is smooth, uninterrupted, and provides you unaltered information to build your case. A licensed and fully trained private investigator can keep tabs on the employee without getting noticed. At Silverseal, we provide surveillance investigation services for businesses that want to mitigate and eliminate fraudulent employee workers’ compensation claims.

A workers’ compensation investigator can carry out discrete operations to ensure employees who file claims are entitled to their benefits and are not trying to lie about their condition. This benefit ensures money is available for workers with valid and legitimate injuries and claims, so your company does not bear the burden of increased premiums. Additionally, investigators help ensure insurance companies are not ripped off consistently by fraudulent employees.

Silverseal Private Investigators Are Trained to Help Your Company Investigate Workers’ Compensation Fraud

Silverseal can help you conduct an effective company compensation fraud investigation. We have the personnel, resources, and skills so you do not have to do it yourself. Our clients have direct access to senior management at any time, meaning you can rest assured your needs and concerns are a top priority. Only highly experienced security experts are at the helm of affairs at Silverseal. Further, all of our solutions are offered at flexible pricing, so we customize our services to meet your unique needs.

We work with you to create customized solutions beyond what is listed on our website, providing comprehensive security solutions that most security firms do not offer. Contact us today to discuss how we can help protect your company’s interest against fraudulent claims.